Qiagen Announces CEO Transition and $225M Acquisition of Parse Biosciences

Qiagen, a leading molecular diagnostics company, has unveiled significant changes in its leadership and strategic direction. The company announced the upcoming departure of its long-standing CEO, Thierry Bernard, alongside a major acquisition in the single-cell analysis market.

CEO Transition and Financial Performance

Thierry Bernard, who has led Qiagen for six years, will step down from his role once a successor is appointed. The timing of the transition has been agreed upon by Bernard and the company's supervisory board. During his tenure, Bernard navigated Qiagen through turbulent times, including a failed acquisition attempt by Thermo Fisher Scientific in 2020 and the challenges posed by the COVID-19 pandemic.

The announcement of Bernard's departure coincides with Qiagen's release of its third-quarter financial results. The company reported a 6% year-over-year increase in net sales, reaching $533 million. Qiagen also reaffirmed its forecast for 4% to 5% growth in 2025 and announced plans to complete a $500 million synthetic share repurchase in early January 2026.

Strategic Acquisition of Parse Biosciences

In a move to expand its presence in the rapidly growing single-cell sequencing market, Qiagen has agreed to acquire Parse Biosciences for $225 million upfront. The deal includes potential additional milestone payments of up to $55 million based on future performance targets.

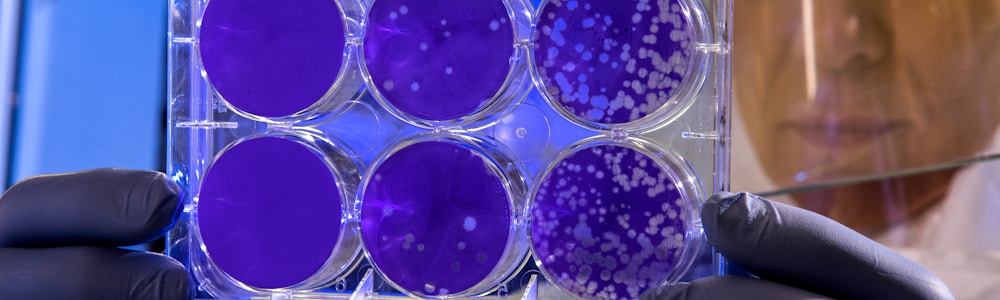

Parse Biosciences, a Seattle-based company, specializes in developing scalable, instrument-free solutions for single-cell research. Their flagship technology, Evercode, enables researchers to profile gene expression in individual cells at scale without the need for specialized instruments. This approach differentiates Parse from competitors like 10x Genomics, which relies on microfluidics and proprietary hardware.

Qiagen expects Parse to contribute approximately $40 million to its revenue in 2026, with projections for strong double-digit growth thereafter. The acquisition aligns with Qiagen's strategy to capitalize on the growing demand for AI-based drug discovery, which is driving an estimated 10% annual growth in the single-cell market through 2029.

Market Outlook and Industry Trends

The single-cell analysis market is poised for significant expansion, with Qiagen estimating growth from $1.2 billion in 2024 to $2.1 billion by 2029. This growth is largely attributed to the increasing adoption of AI-based drug discovery methods, which require massive datasets generated by single-cell technologies.

Qiagen's acquisition of Parse Biosciences is expected to complement its existing sample technology and bioinformatics businesses. The company aims to provide researchers with comprehensive tools for generating the extensive datasets necessary for building predictive virtual cell models, a key component in AI-driven pharmaceutical research and development.

References

- Qiagen inks $225M single-cell buyout as CEO prepares to step down

Qiagen has identified Parse Biosciences’ technology as complementary to its sample technology and bioinformatic businesses.

- Qiagen CEO to step down as company snaps up Parse Biosciences in $225M upfront deal

The news is coming thick and fast for Qiagen. As the molecular diagnostics specialist announced its third-quarter earnings, it also revealed that its long-term chief executive, Thierry Bernard, will step down while also opening its wallet for a new acquisition.

Explore Further

What are the specific terms of Qiagen's acquisition of Parse Biosciences, including the conditions for the milestone payments?

How does Parse Biosciences' Evercode technology compare to competitors like 10x Genomics in terms of cost and scalability?

What are the expected synergies between Parse Biosciences and Qiagen’s existing sample technology and bioinformatics businesses?

Who are the major competitors in the single-cell analysis market, and how does Qiagen's acquisition position them against these rivals?

What impact will the CEO transition have on Qiagen’s strategic initiatives, especially in light of recent financial performance and acquisitions?