Qiagen Shakes Up Leadership and Expands Portfolio with $225M Parse Biosciences Acquisition

Molecular diagnostics leader Qiagen is making waves in the pharmaceutical industry with a series of significant announcements, including a change in leadership and a strategic acquisition aimed at bolstering its position in the single-cell sequencing market.

CEO Transition Signals New Chapter for Qiagen

In an unexpected development, Qiagen revealed that its long-standing Chief Executive Officer, Thierry Bernard, will be stepping down from his role after six years at the helm. The company's supervisory board is now actively seeking a successor, with Bernard set to remain in his position until a new leader is appointed.

Bernard's tenure was marked by notable events, including the company's near-acquisition by Thermo Fisher in 2020 for approximately $12.5 billion—a deal that ultimately fell through following shareholder rejection. Under his leadership, Qiagen has navigated complex market dynamics and continued to innovate in the molecular diagnostics space.

Strategic Acquisition Enhances Single-Cell Sequencing Capabilities

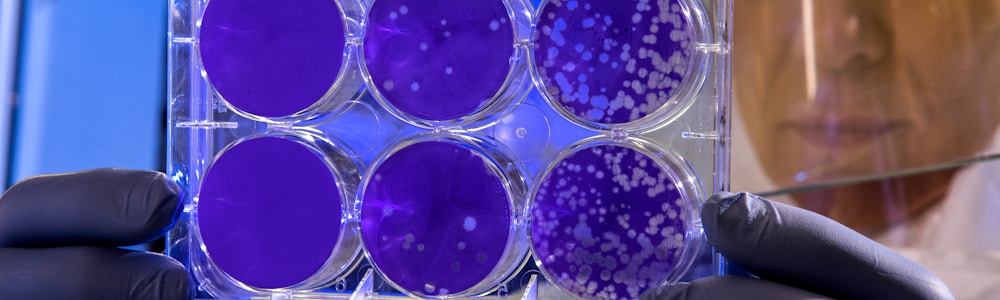

Concurrent with the leadership change announcement, Qiagen disclosed its plans to acquire Parse Biosciences, a Seattle-based company specializing in scalable, instrument-free solutions for single-cell research. The deal structure includes an upfront cash payment of $225 million, with the potential for additional milestone payments of up to $55 million based on future performance targets.

Alex Rosenberg, Ph.D., CEO and co-founder of Parse, expressed enthusiasm about the acquisition, stating, "Parse was founded to make single-cell sequencing accessible to any lab. As our team joins Qiagen, we want to accelerate that mission and extend the reach of our technology to more customers around the world."

This strategic move is expected to significantly expand Qiagen's Sample Technologies portfolio, positioning the company to capitalize on the rapidly growing single-cell sequencing market. Parse Biosciences' technology is designed to handle research involving millions to billions of cells, aligning well with Qiagen's focus on advanced sample processing and analysis solutions.

Financial Performance and Future Outlook

Amidst these transformative announcements, Qiagen reported strong financial results for the third quarter of 2025. The company saw a 6% increase in sales, reaching $533 million. Additionally, Qiagen plans to complete a $500 million synthetic share repurchase in early January 2026, signaling confidence in its financial position and commitment to shareholder value.

The acquisition of Parse Biosciences is projected to contribute approximately $40 million in sales to Qiagen for the full year 2026, further strengthening the company's revenue streams and market position in the life sciences sector.

As Qiagen embarks on this new chapter, the industry will be watching closely to see how these strategic moves shape the company's future and impact the broader landscape of molecular diagnostics and single-cell research technologies.

References

- Qiagen CEO to step down as company snaps up Parse Biosciences in $225M upfront deal

The news is coming thick and fast for Qiagen. As the molecular diagnostics specialist announced its third-quarter earnings, it also revealed that its long-term chief executive, Thierry Bernard, will step down while also opening its wallet for a new acquisition.

Explore Further

What are the key milestones Parse Biosciences is expected to achieve following the acquisition by Qiagen to unlock the additional $55 million in payments?

How does Qiagen's acquisition strategy compare to other competitors in the single-cell sequencing market?

What are the technical advantages of Parse Biosciences' single-cell sequencing technology compared to existing solutions in the industry?

What impact might Qiagen's leadership transition have on the company's strategic direction regarding acquisitions and molecular diagnostics innovation?

Are other major pharmaceutical or biotech companies pursuing acquisitions in the single-cell sequencing space, and how does Qiagen's move position them competitively?